Calculating Customer Lifetime Value and Tips to Increase it

Published On: 02 Sep 2024

By:Lifesight

Within three years of its launch, Native, a natural deodorant brand, grew from zero to $100 million in revenue. Their strategies focused primarily on customer retention. Returning customers account for up to 50% percent of total sales.

Moiz Ali, the company's founder, makes no secret of the fact that prioritizing repeat business and Customer Lifetime Value (CLV) drove the brand's exponential growth and helped seal the deal with Procter & Gamble.

CLV (also known as Lifetime Value or LTV) is one of the most crucial factors in determining the current and future success of your brand. By calculating the net profit you will earn from a customer over the course of your entire relationship, you will be able to determine precisely how valuable they are to your brand.

CLV provides crucial insight into how much money you should invest in acquiring customers by revealing the long-term value they will bring to your business. You will be able to determine which customers you should be focusing on and, more importantly, why you should be focusing on them.

What is Customer Lifetime Value?

Customer lifetime value is defined as the total revenue you earn from a customer over the course of their relationship with you.

It takes into account every order they've ever placed. It is a useful metric for measuring: customer satisfaction, brand loyalty, and brand viability.

Segment your customers for better CLV calculations

Before we dive into calculating CLV, let's examine the pillars of customer value analysis: Recency, Frequency, and Monetary Value (RFM).

RFM is a method for arranging your customers from "least valuable" to "most valuable" based on the following considerations:

By segmenting your customers on the basis of RFM, you'll be able to analyze each segment individually and determine which set of customers has the highest CLV.

To organize your customers with RFM, you'll need three pieces of information about each one:

- The date of their most recent transaction

- The number of transactions they've made within a consistent time frame (a year will work best, in most cases)

- The total amount that they've spent during that same time frame

Hot tip

Lifesight will have prebuilt segments on the basis of RFM. This will enable you to set up automated workflows with personalized messages for each segment to increase customer lifetime value.

How to calculate CLV?

There are many methods of calculating CLV, depending on what data you have available:

1) Accumulated data method

This method assembles all orders from individual customers into their own authentic CLVs:

CLV = Order 1 + Order 2 + Order 3 +……+ Order n (where n is the number of orders)

2) Average estimation method

If you lack granular data, you can approximate an average using the following customer lifetime value formula:

This method provides an estimate if you are in the process of launching your ecommerce store and have only industry data available.

Say you have an average order value (AOV) of $50, and your average customer makes 5 purchases per year and shops with you for approximately 3 years.

To determine your CLV, you would formulate it as follows:

CLV = 50 x 5 x 3

Therefore, CLV = $750

This helps to put your CAC in context. This is excellent news if acquiring a new customer costs $200. But, if you're spending $1,000 on customer acquisition, you have work to do.

This formula is significant because it allows you to determine precisely where optimization is required. For instance, if you have a near-similar AOV and repeat purchase rate year after year, but your customers only stay with you for one year, you need to work on retaining customers after the first year.

If your retention rate is excellent and your repeat purchase rate is not an issue, you should focus on increasing your AOV.

Thus, CLV enables you to make actionable decisions regarding how to treat your customers in the future and how to increase your revenue.

3) CLV based on historical sales data

CLV = AOV x Frequency of purchases x Margin

Let's break down this formula below:

Determine your brand's AOV for the past 12 months. AOV is calculated by dividing the total sales for a given period by the number of orders for that period. (Lifesight's default reports include AOV.)

AOV = Total sales/No. of orders

Next, multiply your brand's AOV by the average number of times a customer made a purchase during the previous 12 months. For instance, in the past year, if your brand had 10,000 orders and 8,250 customers, your purchase frequency would be 1.2.

Frequency of purchase = Total orders/Customer count

Multiply your result by your margin, which is what remains after deducting expenses. Therefore, it would be the AOV minus the cost of goods sold (COGS) and the average overhead expenses.

Margin = AOV - COGS - Average overhead

Remember this

The customer lifetime value should always be calculated, after deducting returns and cost of goods, to show a real contribution margin per customer.

What should your CLV: CAC ratio be?

Once CLV has been determined, you can use it to determine your desired CAC. Instead of targeting customers with high initial revenue, concentrate your acquisition efforts on customers with a high CLV. Even if their initial purchase is modest, they will bring greater value to your company in the future.

Customer acquisition is unprofitable only if the customer acquisition cost exceeds the customer lifetime value. For most brands, the CLV to CAC ratio for each marketing segment should be 3:1. If you spend too much (say, a ratio of 1:1), acquiring these customers will not be profitable.

Take Casper as an example, a brand that started the trend of selling mattresses online in 2014. The brand has been struggling to turn profitable despite its initial success.

Gaining new customers has been challenging because of the increasing number of competitor brands in the market that are competing for the same audience.

In addition, mattresses have a long lifespan (about 10 years), so customers don't typically return to buy another one. With acquisition expenses at an all-time high, Casper has very little room to make a profit with a low CLV.

Latest CLV benchmarks

What should the CLV be for most ecommerce brands?

Obviously, this is contingent upon the products you sell and your business model. For instance, if you're selling wedding dresses, only you would know whether they're a popular item for repeat orders!

However, according to Metrilo's recent report on customer retention in DTC brands, the average CLV across brands is $168, ranging from $55 (tea) to $477 (CBD oil *).

The brands in the top quartile have 5x higher CLV than the rest of the brands as per this 2022 Benchmark Report by RetentionX:

Tips and strategies to increase your CLV

All CLV formulas demonstrate that a higher AOV and a higher order frequency per customer constitute the gold standard of DTC performance - a high CLV.

1) Increase AOV: Obtain larger orders consistently

The following strategies build on the foundation of upselling and cross-selling. These tips fill gaps in your conversion strategy that may be causing customers to be cautious and place small orders:

- Create data-driven product bundles

The emphasis is on data-driven. Ensure that your apps and tools make automatic product recommendations, but confirm that these suggestions are made based on past purchase data.

Even if you set up product bundles yourself, it's a subjective matter, and you may be wrong about which products pair well.

The beauty of data-driven marketing is that it eliminates the need for guesswork.

Look at what your customers frequently purchased together, as these are the bundles they value.

- Make choosing easier

A diverse product selection is desirable, but when there are too many options, consumers face the paradox of choice.

If you make it easier for people to decide, they will feel more comfortable shopping with you and will be more likely to purchase additional items. This enhances customer satisfaction.

To achieve this, you can provide filters for product selection, carefully select products that go together (clothes and accessories, party supplies, food, and drinks, etc.), and use categories that are less general (such as dresses) and more relevant to the buyer's objective (for instance, wedding guest dresses, spring break party dresses, modest work dresses, Halloween costumes, and so on) similar to what Sephora does here:

- Add complementary products for convenience

People who shop online already place a premium on time and convenience. However, extra effort is not harmful if you can recommend supplementary items required for optimal use of the primary product people purchase.

For instance, a frying pan can function independently but adding a set of bamboo utensils that won't scratch it is a thoughtful addition that many will appreciate. It saves time and improves the usability of the product. Or recommend data cables that go well with smartphones and their accessory bundles.

- Give a free product if they buy more

To increase AOV, provide freebies (old stock, new product tests, small cards, and trinkets) or samples with orders over a certain amount.

To pique people's interest and make a high-priced order appear alluring, you can even offer a really nice and large item for the highest order tier, such as over $200.

- Have a risk-free returns policy

Yes, you probably accept returns, but things become complicated when customers with larger orders return items and their order value falls below the threshold for free shipping.

In such cases, you should simply let it slide and not charge for shipping.

True, there are people who take advantage of such policies, but you're working to make shopping enjoyable for your good, honest customers, who will continue to purchase from you.

As a result, they will be more willing to place generous orders.

Hot tip

Always tweak and customize your returns policy backed by data on certain customers/customer segments. Do not offer free returns to customers who've returned a few products.

Also, keep an eye out for any anomalies or spikes in returns. If there is a spike happening for a certain product/category/region, you need to analyze what's causing more returns: Is there any defect in the product? Is the destination address causing shipping issues?

2) Increase order frequency: Get orders more often over the customer lifespan

Customer retention is predicated on receiving repeat orders from existing customers. You should know, backed by data, how frequently your customers return for additional or repeat purchases.

Obviously, it depends greatly on your products and product lifecycle.

Messages, sent via their preferred channel, precisely when customers are ready to purchase again will work wonders for reactivation. For instance, this simple back-in-stock alert with a small discount works well for people to get items they were interested in:

- Follow a data-driven promo calendar

If you wish to expedite the process and reduce the time between orders (TBO), your promotions must be more dynamic and data-driven. Just doing the run-of-the-mill Christmas, Spring, Fourth of July, and back-to-school sales will not generate much buzz as you're likely to be lost among a mountain of offers and sales.

Instead, add some flavor. Different groups of customers prefer various types of promotions, so expanding your scope will increase your return on investment.

For instance, March is the only month with International Women's Day, the First Day of Spring, St. Patrick's Day, Easter, and World Wildlife Day promotions!

June is Pride Month and ends with the 4th of July just around the corner; maybe do a combo promotion that covers both events:

Find out what calendar events make your customers click based on past-purchase history. Something that your customer will value.

- Have good surprises in the order packages

Make receiving a package a memorable moment. The key to keeping your customers surprised and coming back for more is a wonderful unboxing experience.

Send your products with extra love and care by including free gifts, personalized notes, and fun packaging.

Maybe add something useful, such as a bookmark (with a new book), a handwritten note, or free samples of a new product.

- Minimize returns

How can you ensure that customers receive exactly what they expect?

First, explain everything in the product description, including the material, appropriate uses, maintenance and supplies required, etc., so that the customer is aware of everything in advance.

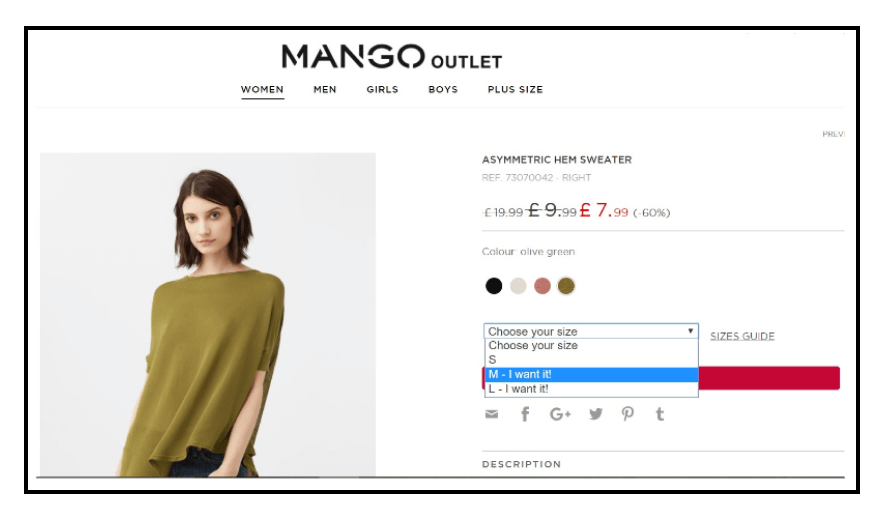

Your product images (and videos, if possible) should display back, front, special details, hems, labels, zippers, and texture – everything that customers look for while buying a product in a physical store should also be visible on your site and in your messages.

If selling clothing or shoes, make sizing clear. It is best to adhere strictly to a standard system, such as the US/EU/UK system. If not, list the measurements that correspond to your sizes so that customers can easily select the appropriate size.

- Personalize marketing messages

We live in an era of personalized marketing. For instance, there is no reason to send your new sports collection to a customer who has never purchased athleisure items from you but only formal shirts.

You can't force everyone to buy all of your products, so it's wiser to provide them with what they desire.

- Consider subscriptions to hook customers.

Do you sell something like coffee beans or socks that people need to buy often?

Think about setting up a subscription model to lock in repeat business. You can set up daily, weekly, monthly, or even customized subscriptions based on your product lifecycle and customer preference.

This makes repeat orders easier for you and your customers.

- Enable shipment tracking

Did you know customers check their shipment tracking an average of 4.6 times for each online order?

With the advent of digital-first logistics players and new apps, it is easy to create custom tracking page experiences that eliminate WISMO and thus, drive more sales in the future.

Putting your CLV to work: Improving your bottom line

You always pay for the initial order from a customer, regardless of subsequent orders. It could reach up to $100 per new customer. Most likely, you will lose money on your first sale. This is one of the realities of ecommerce.

Here, CLV comes into play. It is the difference between the success and failure of your brand.

If you develop a long-term strategy and strive for a higher CLV, you are planning to increase your return on investment. You are consciously planning how to offset and maximize the initial cost of acquisition. Each sale to a returning customer increases your profitability:

Profit from a customer = Gross Revenue - COGS - Overhead - CAC

Therefore, if CAC is paid only once, your profit from a customer increases with each successive order from them.

As your profitability increases with CLV, you will be able to invest in the creation of new products, hire more employees, and enhance your operations and branding.

Related Blogs

Growth Unveiled

Interviews, tips, guides, industry best practices, and news.

Best Customer Retention Campaigns With Examples

Discover the best customer retention campaigns! Learn from these 10 examples and create your own successful retention st...

How to Build Brand Equity for Your D2C Brand

Discover proven strategies to strengthen brand equity for your direct-to-consumer brand. Elevate your presence and drive...

The Ultimate Growth Strategies For Your Ecommerce Brand

These ecommerce growth strategies must be established from the start 1. Develop a unique brand story 2. Create an easy-t...

Future-proof your marketing measurements

Forecast accurately with no-code ML & AI model setup that provides comprehensive predictive insights

Stay in the know with always-on measurements providing real-time channel performance